SBA EXPRESS LOAN

SBA Express offers faster access with longer terms and lower down payment requirements compared to conventional loans.

- Use for real estate, line of credit, working capital, inventory, funding tenant improvements or purchasing machinery and equipment

- Borrow up to $500,000

- Repayment terms up to 25 years

SBA 7(A) LOAN

Supporting small business expansion is our specialty and SBA 7(A) loans offer favorable rates and longer repayment terms.

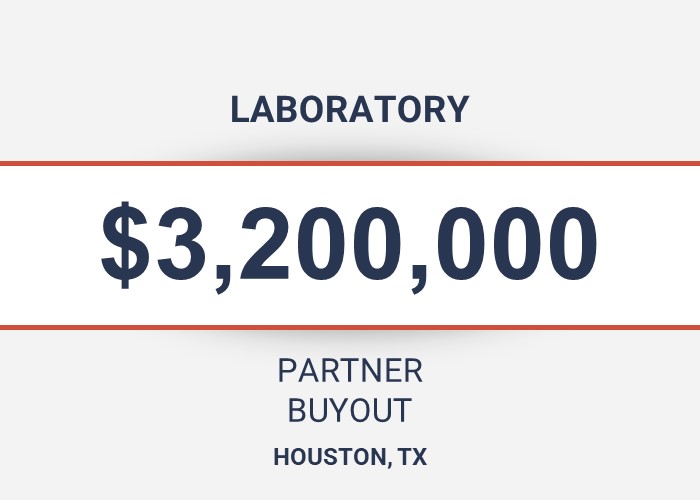

Funds can be used for equipment and real estate purchases, working capital, basic startup costs, construction, partner buyout, business acquisition and even debt refinancing.

- Borrow up to $5,000,000 on a competitive rate

- Terms up to 25 years for commercial real estate and up to 10 years for all other purposes

SBA 504 LOAN

Plan to expand through a real estate or equipment purchase? SBA 504 is a perfect option.

Funds can be used for major fixed asset purchases of real estate, equipment, new facility construction or the purchase or renovation of an existing property.

- SBA debt portion up to $5,500,000 and total project size up to $20,000,000

- As little as 10% equity contribution

- Long-term fixed rate on the SBA debt portion

SBA Leadership

TOMMY C. FORSYTHE

Executive Vice President | SBA Lending

Tommy and his team have an extensive background in SBA lending and offer expert guidance on the loan process for small businesses.

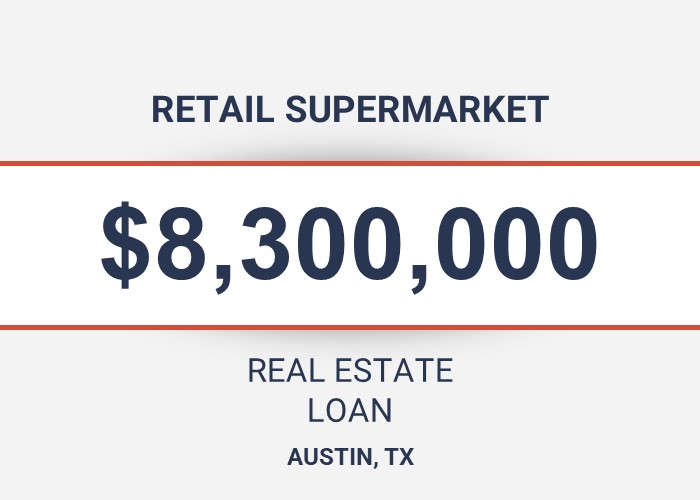

Recent Deals

1. Per Austin Business Journal's list of top 7(a) lenders in 2023. 2. Subject to credit approval. Shared agreement with Independent Financial and the Small Business Administration. SBA packaging fee may apply.